The e-commerce industry is in a perpetual state of evolution. And, as more brands rely on the Internet to market and sell their products, maintaining a competitive edge is becoming increasingly important.

Whether you sell SaaS or sneakers, keeping up to date with evolving e-commerce statistics and trends is a crucial strategy for any online business that wants to survive the coming years.

At a glance, 2023 and 2024 are shaping up to be big years for e-commerce:

- The e-commerce market is projected to reach $6.3 trillion by the end of 2023.

- China accounts for more online retail sales than any other country.

- By 2024, more than 21.2% of all retail sales will happen online.

- Recent studies show that 218.8 million US citizens regularly shop online in 2023

More brands are entering the online market than ever before, amplifying the need for an in-depth understanding of it. The more you know about what to expect from the future of e-commerce, the easier it is to adapt your marketing strategy to meet the demands and expectations of consumers across the world.

We’ve rounded up an extensive list of e-commerce statistics, trends, and market forecasts for the rest of 2023 and heading into 2024.

Let’s see what the market has in store.

- General e-Commerce Statistics

- US e-Commerce Statistics

- Global e-Commerce Trends

- e-Commerce Forecast For 2023 And 2024

- B2B eCommerce

- E-commerce In Emerging Markets

- Payment Providers

- CMS

- Traffic Sources

- M-commerce Expansion

- Omnichannel Retail

- Cross-Border E-commerce

- Sustainability And Green E-commerce

- AI And Personalization

- AR And VR In e-Commerce

- Supply Chain Resilience

- Innovations in Delivery And Fulfilment

- Data Privacy Regulations

- Voice Commerce

- Niche E-commerce Markets

- Global Trade Agreements

- E-commerce Advertising

- Cybersecurity

- Consumer Behavior Changes

- E-commerce In Emerging Markets

- SME E-commerce Growth

- Marketplace Dominance

- Top SaaS Solutions For E-commerce

- Conclusion

General e-Commerce Statistics

The e-commerce industry has seen significant growth over the past decade. International revenue just hit over $6 trillion as 2023 comes to a close, but the value is expected to reach $6.9 trillion in 2024 and $8.148 trillion by the end of 2026.

- The current number of digital buyers is 2.64 billion worldwide.

- The E-commerce penetration rate was 19% in 2022. It’s now expected to reach 25% by 2027.

- China has the strongest e-commerce market, followed by the US, the UK, and Japan.

- Products with the highest e-commerce sales rates are clothing, shoes, consumer electronics, books, movies, home entertainment, and personal care and beauty.

- Global inflation pressures are on the rise, becoming a leading concern for 40% of e-commerce brands, ranking higher than coronavirus, social inequality, and unemployment.

US e-Commerce Statistics

The US is the second-most successful nation in e-commerce sales. Between 2020 and 2023, the penetration rate of e-commerce in the US has doubled, and it’s now sitting at 35% overall.

The US is home to some of the most successful e-commerce marketplaces in the world, namely Amazon, eBay, Wish, Target, and Etsy. At $1.137 trillion, US online sales grew by 9.3% in 2023. Steady growth is anticipated for the next decade, with experts projecting a year-on-year increase of at least 10% until 2027. 70% of Americans shop online. The country’s digital buyer count is 268 million, expected to reach 285 million by 2025.

The top product categories with the highest ecommerce sales in the US are consumer electronics, apparel and accessories, furniture, home decor, auto parts, and personal care.

Overall, there’s a huge consumer demand for the convenience and commodification of online shopping in the States, and it’s not expected to slow down anytime soon.

Global e-Commerce Trends

Trends come and go, but that doesn’t mean they aren’t worth taking seriously. They inform brands about what consumers want from e-commerce platforms and the various ways in which they’d like access to them.

Since 2020, we’ve seen a sharp increase in interest in mobile shopping, social commerce, and cross-border e-commerce. Let’s take a closer look:

- Mobile shopping (AKA m-commerce) sales accounted for 43.3% of all e-commerce sales in 2023, up from 41.8% in 2022.

- M-commerce sales revenue is expected to reach $534.18 billion in 2024.

- Social commerce has an expected compound annual growth rate (CAGR) of 31.6% between 2023 and 2030.

- Cross-border e-commerce is expected to grow by a massive 108% between 2023 and 2028.

- The emergence of new payment methods is projected to continue its upward spate, with contactless payments such as mobile wallets, crypto, QR codes, and debit cards leading the way.

- Sustainability will become a main priority for ecommerce businesses, with its high consumer demand and need for transparency in the social and legislative aspects of a business.

e-Commerce Forecast For 2023 And 2024

E-commerce sales are climbing higher every day. In 2022, the global online retail revenue was $5.2 trillion, and it’s expected to reach $6.3 trillion by 31st December 2023. By 2024, analysts predict it will hit a total of $8.1 trillion by the end of the year.

Some of the trends expected to shape the ecommerce landscape throughout 2024 include:

- More generative text from AI for product descriptions, videos, and photography advertising.

- Augmented reality merges with shopping experiences to give customers new perspectives on products.

- Predictive analytics will prevent inventory stockouts (46% of consumers say they will move to suppliers who always have the products they want in stock).

- More personalized shopping experiences.

- Customers lean towards self-service.

- Same-day delivery expectations will increase.

- Automated returns management will become more integrated.

But the e-commerce industry of 2024 is not going to come without some challenges. Some of the biggest challenges that online retailers can expect to face are limited internet penetration, navigating complex cross-border logistics, and competing with the rising surge of other brands.

However, these challenges will come with the opportunity for significantly expanded consumer bases, heightened marketing campaigns thanks to AI and generative content, and penetration into niche markets.

B2B eCommerce

B2B sellers are grappling with the adjustment to digital territories. The B2B buyers of 2023 (and 2024, as well as the prospective future in general) prioritize two things above all else:

Speed and convenience.

Thanks to the extremely efficient way that these two priorities are being met, the growth of B2B ecommerce sales is projected to reach $3 trillion in the US by 2027, a figure almost double what it was in 2021 at $1.7 trillion. Key trends in B2B ecommerce for 2024 are:

- Purely digital catalogs

- Customized pricing

- Streamlined ordering systems

- Loyalty programs to incentivize repeat business

E-commerce In Emerging Markets

E-commerce is an effective way to empower new markets in the online marketplace, which is why so many emerging markets are drawn to the current digital landscape. With reduced operational costs and an expanded consumer bracket, growth is a natural outcome for new brands.

However, the dynamism and rapid growth of emerging markets bring both challenges and opportunities. Some of the main challenges emerging markets should brace themselves for in 2024 include:

- Overcoming complex regulatory and security hurdles

- Adhering to sustainability compliances from a cross-border perspective

- Scalability restrictions

- Balancing high marketing and advertising costs

- Over saturation and high levels of competition

If emerging markets can create ample infrastructure to support themselves in this highly saturated and competitive landscape, the opportunity for growth and revenue is massive.

Payment Providers

Payment providers play a key role in the success of e-commerce in 2024 and beyond. In 2023, the most popular payment mechanisms are Apple Pay, Google Pay, PayPal, Venmo, Alipay, Square, and Buy Now Pay Later methods. The growth of these payment channels is closely related to the growth of the e-commerce platforms they connect to.

Let’s take a look at their revenue growth in 2023:

- PayPal’s total revenue for 2023 is reaching $7.4 billion in 2023, 9% higher than in 2022.

- 73.1% of Gen Z shoppers used Apple Pay to make a purchase during a period of one week.

- By the second quarter of 2023, Venmo’s year-on-year increase lifted to 9%, placing its revenue so far at $6.7 million.

- Cashless payment transactions are set to increase by 200% before 2030, eventually replacing cash-based systems entirely.

We can expect to see a few key trends in ecommerce payment providers across 2024, but primarily the shift into an almost exclusively digital payment system that focuses on fast, fuss-free online transactions.

CMS

The growth of ecommerce CMS like Shopify, Magento, and Woocommerce has been prolific. Content Management Software (CMS) plays a vital role in allowing e-commerce platforms to run smoothly and effectively, allowing for better customer service and higher sales.

Some key trends by G2 in e-commerce CMS to look out for in 2024 include:

- AI-powered personalization

- Optimized mobile infrastructure for m-commerce

- Increased integrations between multiple apps and e-commerce platform management

Traffic Sources

The way consumers arrive at a sales point or site changes depending on who they are, what kind of device they are using, and how they approach online shopping.

In 2023, search engines like Google still rank highest as the most-used traffic source at 48.2%, while social networks come second at 43.1%, and consumer reviews land a surprising third at 36.3%. Knowing this, brands are strategically growing traffic by budgeting more for SEO, paid search campaigns, and encouraging consumers to publish reviews of their experiences online.

Organic social media campaigns such as those implemented on Pinterest, TikTok, and X are expected to continue attracting consistent attention online, particularly among younger demographics.

M-commerce Expansion

Mobile commerce (m-commerce) is expected to continue to grow rapidly, accounting for an increasing share of overall e-commerce sales.

- M-commerce retail sales are expected to reach $710 billion before 2025.

- Although m-commerce refers to any type of non-computer-based online purchase, smartphones account for 87.2% of all m-commerce sales.

- In 2024, there is expected to be an average of 283 million active m-commerce shoppers in the US alone.

- Dedicated mobile commerce apps perform better than browsing an online store via mobile web

- With over 30 million downloads in 2022, Amazon Shopping is the most popular platform for both iOS and Android to shop on.

- 46% of shoppers prefer doing product research on a mobile device.

Omnichannel Retail

Retailers are increasingly adopting omnichannel strategies to integrate their online and offline experiences. This includes offering seamless shopping experiences across all channels, such as buy online, pick up in store (BOPIS) and ship from store (SFS).

- Brands that offer an omnichannel experience (three or more channels) have a 287% higher purchase rate than those that operate on a single-channel platform

- Customer purchase frequency increases by 250% when offered an omnichannel experience

- A Target survey found that omnichannel customers spend up to 4 times as much as in-store customers

- Omnichannel customers have a 30% higher lifetime customer value than single-channel customers

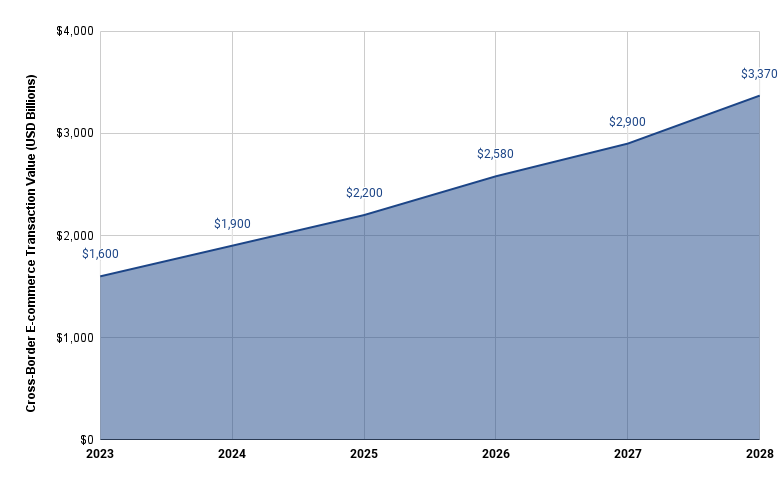

Cross-Border E-commerce

Cross-border e-commerce is another growing trend as consumers become more comfortable shopping from international retailers. Key markets for cross-border e-commerce include the United States, China, and Europe. Recent research suggests that cross-border transactions will increase by 107% by 2028.

- 2023: $1.6 trillion

- 2024: $1.9 trillion

- 2025: $2.2 trillion

- 2026: $2.58 trillion

- 2027: $2.9 trillion

- 2028: $3.37 trillion

Sustainability And Green E-commerce

E-commerce businesses are increasingly focused on sustainability and reducing their environmental impact. This includes initiatives such as using recycled packaging, offering carbon offset options, and

reducing emissions from shipping and delivery.

Increasingly, consumers are showing more interest in green alternatives and the vast majority claim they are willing to pay more for access to sustainable products or shipping methods.

- 73% of consumers say they would either probably or definitely change their shopping behavior to minimize their impact on the environment

- 70% of consumers would pay 5% more for products to reduce environmental pressures

- 90% of major investors prioritize ESG performance of brands

AI And Personalization

Artificial intelligence (AI) is playing a growing role in e-commerce, particularly for personalization and recommendation systems. AI-powered systems can help retailers understand their customers’ needs and preferences and deliver more personalized shopping experiences.

- AI category reviews have increased by 159% since 2020, signalling a dramatic rise in usability

- Voice-activated shopping is expected to become further integrated into the consumer experience

- 47% of business leaders identify data accuracy as the most important feature of personalized AI shopping features and products

- 59% of consumers are comfortable with (and partial to) AI personalization

- 56% of consumers who utilize AI-led personalization experiences are likely to become repeat buyers

AR And VR In e-Commerce

Augmented reality (AR) and virtual reality (VR) applications are becoming more widely used in e-commerce every year. AR can allow shoppers to view products in their homes or on their bodies before they buy them, while VR can create immersive shopping experiences.

- Studies estimate that there will be 173 billion active AR users on mobile in 2024.

- 57% of consumers say that they are more likely to buy from a brand if it offers AR features.

- VR and AR experiences are as much as 200% more engaging than regular shopping experiences.

- 70% of consumers surmise that AR and VR can enhance their consumer experience.

- AR can help reduce the number of returned products due to its immersive benefits.

Supply Chain Resilience

E-commerce businesses are focusing on improving supply chain resilience after disruptions in previous years. This includes measures such as diversifying suppliers, increasing inventory levels, and investing in new technologies.

- E-commerce logistics market value has gone from $15.58 billion in 2020 to $21.95 in 2023, and the value is estimated to reach $31 billion before 2026.

- Globally, the most prominent logistics manufacturers in the e-commerce sector are Mac World Logistics LLC, Kuehne + Nagel, Blue Dart, Swisslog ME, Aramex, UPS, and SEKO Logistics

- 35% of retailers consider lowering mileage to be a main priority for reducing costs and carbon footprints.

- Global supply chain market CAGR anticipated to reach 11.2% between 2020 and 2027

- 55% of supply chain companies are seeking to adopt AI for enhanced management and logistics before 2026.

Innovations in Delivery And Fulfilment

New delivery and fulfillment technologies are emerging to meet the growing demands of e-commerce. This includes drone and autonomous vehicle deliveries, as well as micro-fulfillment centers located closer to customers.

Looking ahead to 2024, here’s what e-commerce brands can expect in terms of what consumers want for more satisfying delivery services:

- Drone delivery may play a more prominent role in local e-commerce deliveries.

- AI-supported enhanced live tracking will be more appealing to consumers.

- Green logistics will become an increasingly popular choice, even if consumers have to pay more

- Customized and personalized delivery options (such as gift wrapping and personalized labels) to become more popular in 2024.

- Integrated AI systems for more seamless stock management and delivery.

Data Privacy Regulations

Consumers have every right to be concerned about where their data is kept and how safe it is. Data privacy regulations, such as the General Data Protection Regulation (GDPR) and the California Consumer Privacy Act (CCPA), are having a significant impact on e-commerce operations.

Businesses need to ensure that they are in compliance with these regulations when collecting and using customer data. Here are some stats on the subject:

- 75% of consumers will have their data protected by privacy laws by 2024. In 2020, that number was only 65%, indicating some progress in this area

- 79% of consumers say that an e-commerce site’s data privacy regulations are a major buying factor

- 71% of consumers won’t buy products from a site they don’t completely trust

- 48% of consumers have left an e-commerce platform that did not appear legitimate

Voice Commerce

Voice-activated shopping through devices like smart speakers is on the rise. This trend is expected to continue to grow in the coming years as more consumers become comfortable using voice assistants to shop. They can also be used to help people with disabilities, appealing to a much wider demographic of buyers.

- Voice commerce is estimated to grow in popularity and usage by 54% in 2024.

- Already, 22% of consumers make purchases directly through their voice.

- 71% of consumers prefer to vocalize their shopping queries than manually typing them

- Voice commerce is most popular for product research.

- An average of 80% of consumers are satisfied with their voice commerce shopping experience

- 60% of consumers in the US say that they use their smart home voice-activated devices to make daily or weekly purchases.

Niche E-commerce Markets

Niche markets, such as luxury goods, health, and wellness products, are growing rapidly in e-commerce. Retailers are focusing on these markets to offer more specialized products and services to their customers. In 2024, these niche markets are tipped for success:

- Home office and remote work essentials

- Eco-friendly home products

- Tech accessories and gadgets

- Pet products

- Sports and home fitness accessories

- Online courses

- Men’s beauty products

- Organic food on demand

Global Trade Agreements

International trade agreements, such as the Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) and the Regional Comprehensive Economic Partnership (RCEP), are making it easier for e-commerce businesses to trade across borders.

E-commerce Advertising

E-commerce businesses are investing heavily in digital advertising to reach their target customers. This includes advertising on platforms like Google, Facebook, Instagram, and Amazon, which all contribute to significant traffic on e-commerce platforms around the world.

- The annual e-commerce ad spend in the US is $12.5 billion in 2023.

- The US has the highest ad spend globally.

- Global e-commerce advertising budgets cap $602 billion in 2023

- By 2026, more than 69% of advertising spending will be generated on smartphones.

- Google Ads and Facebook have the most consistently high ROI across platforms.

- Digital marketing’s CAGR is projected to be 17.6% from 2020 to 2026.

Cybersecurity

Cybersecurity is a growing concern for e-commerce businesses, as they are increasingly targeted by cyberattacks. Businesses need to implement robust cybersecurity measures to protect their customer’s data and systems. Customers are showing increasing (and justified) concern about privacy, prompting businesses to fatten up their cybersecurity budgets and take privacy regulations more seriously.

- By the end of 2023, cybersecurity breaches will have cost the global economy more than $10.5 trillion in total.

- By 2026, 70% of boardrooms will include at least one cybersecurity expert.

- Cybersecurity spending is expected to account for 42% of corporate spending in 2024, putting the global spend at approximately $90 billion.

- Cybersecurity spending has increased by 70% since 2019.

Consumer Behavior Changes

Consumer preferences and behaviors in online shopping are constantly changing. E-commerce businesses need to stay up-to-date on these changes to remain competitive.

These are some of the biggest behavioral changes to expect from consumers in 2024:

- High preference for brands with sustainable options

- Greater surge of online shoppers than ever before

- Need for diversified product ranges

- More mobile-friendly shopping webpages to navigate

- Subscription-based purchases

- AR and VR engaging e-commerce experiences

- Focus on customer feedback, reviews, and testimonials

E-commerce In Emerging Markets

E-commerce is growing rapidly in emerging markets. These markets offer significant opportunities for e-commerce businesses. Countries that offer the highest traction and ROI for collaboration include:

- India

- Indonesia

- Brazil

- Denmark

- Africa

SME E-commerce Growth

Small and medium-sized enterprises (SMEs) are playing an increasingly important role in e-commerce. A growing number of SMEs are entering the e-commerce space, and there are a number of programs and resources available to help them succeed.

- SMEs account for roughly 20% of the e-commerce industry.

- Outside of the e-commerce world, SMEs make up 50% of employment and 90% of businesses.

- 73% of SMEs have their own website where they sell their products from.

- SMEs that sell via major e-commerce platforms are more likely to see higher sales.

Marketplace Dominance

Major e-commerce marketplaces continue to dominate the e-commerce landscape. These marketplaces offer a wide range of products and services at competitive prices, and they are convenient for shoppers to use. The e-commerce brands currently dominating the marketplace include:

- Amazon

- eBay

- Rakuten

- Etsy

- TaoBao

- Ali Express

- Walmart

- Allegro

- Flipkart

- Craigslist

Top SaaS Solutions For E-commerce

Software as a Service (SaaS) has become an indispensable tool for brands and e-commerce platforms around the world that want to improve their internal operations and deliver better digital services to consumers. The best SaaS solutions for e-commerce moving into 2024 are:

- Statusbrew

- Moosend

- Hubspot CRM

- Shopify

- Asana

These ecommerce tools are designed to equip brands with everything they need to set up, manage, and enhance digital shopping experiences while providing comprehensive services to consumers. Some up-and-coming tools to look out for also include Woodpecker, Brand24, and AdCreative.

Conclusion

Understanding the complex world of e-commerce statistics, trends, and predictions may feel like a Sisyphean process, but it’s worth it to be ahead of the curve. With this information, you can develop an e-commerce marketing and management strategy that stands out among the crowd.